The BV comic

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

LATEST PODCAST

October 2024

Five frightening financial charts to fear this Halloween!

By Joe Sullivan-Bissett - 31 October 2024

As Halloween approaches, it’s not just ghosts and ghouls that are causing fear – financial markets are also giving us plenty of reasons to be spooked. From crumbling consumer confidence to rising debt burdens, the economic landscape is littered with eerie signs of instability. In this year’s roundup, we explore five charts that reveal unsettling trends in global markets.

Happy Halloween!

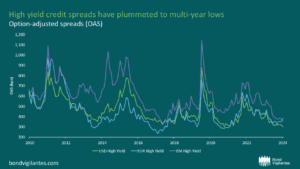

High yield bonds: excess spread vs excess optimism?

By Charles de Quinsonas - 29 October 2024

With the US Treasury curve yielding above 4%, high yield (HY) bonds still offer mid-single digit yields. As of the end of September, US high yield, European high yield and emerging markets (EM) corporate high yield bonds were offering 7.0%, 6.1% and 7.4% respectively. Credit spreads, however, have plummeted to multi-year lows and the eternal debate between all-in yield vs credit spreads continues. Credit spreads matter because, at an index level, they need to overcompensate for future defaults. Otherwise, there would be no reason to…

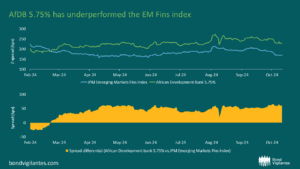

Hybrid capital for Development Banks – an emerging asset class?

By Nick Smallwood - 17 October 2024

In January 2024, the African Development Bank (AfDB) issued the first hybrid capital instrument ever issued by a Multilateral Development Bank (MDB). Despite initial hopes that this would be the first of several such instruments, allowing MDBs to leverage private capital to support development projects globally, this remains the only such bond in existence. Why has this market failed to grow? Is this instrument really suitable for MDBs? And does it have a natural investor base?

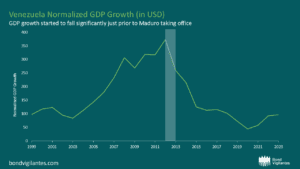

99 Problems and Maduro is One

By Michael Talbot - 10 October 2024

What does a 1990s hip-hop artist from Brooklyn, and an oil-rich South American country have in common? Surprisingly, a shared struggle. Jay-Z famously faced 99 problems, while Venezuela’s was one, much larger, issue: Nicolás Maduro

Their career paths were equally unconventional. Jay-Z transitioned from a high school dropout to a global hip-hop icon whilst Nicolás Maduro journeyed from a bus driver to the President of Venezuela. By comparison, it makes my not-so-meteoric rise from a university bartender to an investment specialist seem relatively spiritless.

Economic juggling: the complexities of monetary policy amid soaring debt

By Robert Burrows - 8 October 2024

In recent years, the transmission mechanism of monetary policy—the intricate process through which central bank actions impact the economy—has undergone significant changes, notably as global debt levels have surged. With governments around the world carrying heavier debt burdens, the impact of rising interest rates on the economy has shifted in ways that policymakers must grapple with.

September 2024

Germany’s lagging economy: could fiscal restraint be a long-term strength amid global debt woes?

By Robert Burrows - 24 September 2024

Germany, long known for its robust economic engine, is experiencing a slowdown. While several factors contribute to this economic stagnation, the country’s strict adherence to its fiscal policy has been a key driver, notably the “debt brake”. The debt brake, enshrined in the German constitution in 2009, limits the amount of new borrowing the government can undertake, keeping fiscal spending under tight control.

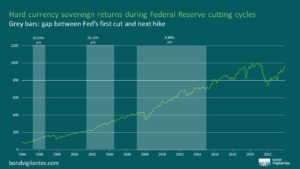

The Fed’s easing era

By Michael Talbot - 20 September 2024

It’s often said that the first cut is the deepest, and that may well be the case for the US Federal Reserve (Fed) delivering a blockbusting 50 basis point (bp) cut. After 918 days, this marks the end of the monetary policy tightening brought in to tame the “transitory” inflation that came to a thunderous crescendo in 2022.

The peculiar relationship between Oasis and periods of extreme market volatility

By Joe Sullivan-Bissett - 2 September 2024

News on Tuesday 27th August took the music industry by storm: Oasis are doing a reunion tour. I’m happy (if not a little bit nervous in social circles) to admit, I am not the most avid of Oasis fans. Sure, everybody loves “Wonderwall”, and “Don’t Look Back in Anger”, and “Champagne Supernova”, and… you see, that’s all I can come up with. But, despite my love for this genre being committed to a different band from the UK – clue in the ‘heroes’ section of…